With the Fourth of July just around the corner, we’ll be celebrating the country’s declaration of independence with cookouts, parties and fireworks. But there’s another type of independence we celebrate at The Foundation—financial independence for women. For those who have it, they are secure in the fact that they have sufficient personal wealth to live with more resources and less stress. Their assets generate income that is greater than their expenses. For those who are economically insecure, however, the path to financial independence can be hard but achievable.

Financial security comes from income, savings, and assets that allow a family to create a safety net to absorb short-term shocks and to turn long-term dreams into reality. While steady income is important to moving women out of poverty, assets help women build financial security and open new doors to opportunity. Nevertheless, even as the U.S. economy continues to recover from the Great Recession, a large share of American families are struggling to make ends meet, and more are struggling to save. Many of the milestones of middle class success—homeownership, retirement security, and access to higher education—are becoming harder to achieve for more and more Americans.

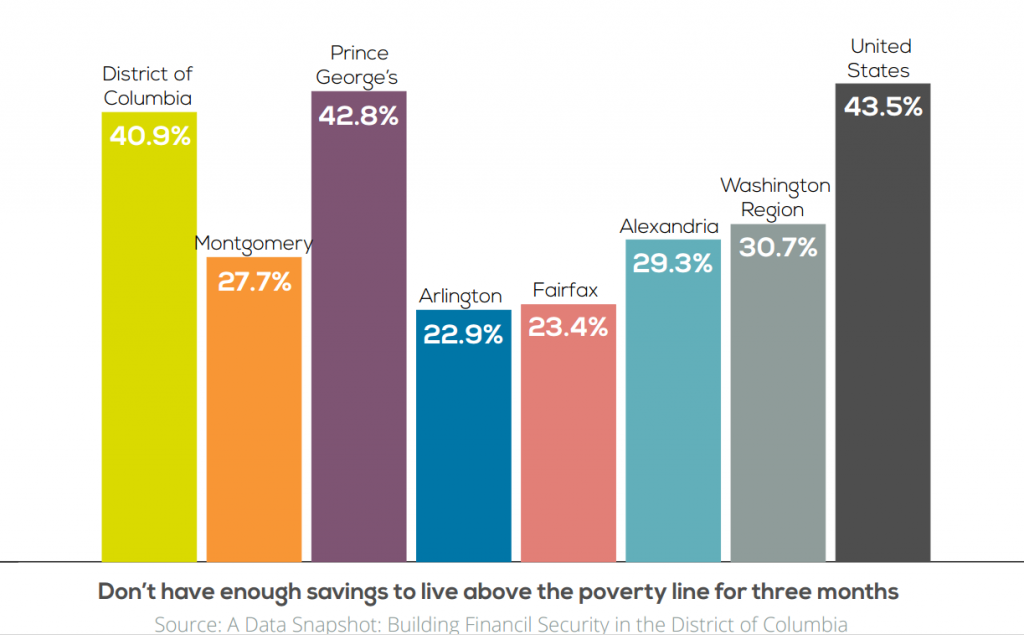

More than half of American families are not financially prepared for an unexpected expense, break even or spend more than they make each month, and have a very limited ability to build assets. A full third of American families (33 percent), for instance, reported having no emergency savings whatsoever. In the Washington region, close to one third of families (31 percent) do not have enough savings to live above the poverty level for just three months if they have an income disruption. This situation is critically common among single-parent households—most likely headed by single women—households of color, and low-income households.

Low-income women can and have the capacity to save with the right combination of support, knowledge, financial products and public policies. The Women’s Foundation’s investments help support low-income women in the Washington region through their asset building journey. From financial knowledge—such as learning how to access their credit report, correcting any errors, and negotiating and paying down debt—to increasing their savings and income from new employment, or accessing tax credits for which they qualify. During the 2015 fiscal year, The Women’s Foundation’s funding helped about 1,134 women receive the Earned Income Tax Credit and these women increased their assets by $1.9 million. An additional 276 women participated in financial education programs, increasing their savings, decreasing their debt, and improving their credit scores.

In times of economic hardship, savings and assets become the safety net needed to keep families afloat. The Women’s Foundation works tirelessly supporting women to build assets and create a solid foundation of financial independence for all.